- SalesDaily for Leaders

- Posts

- 💡 spot it early

💡 spot it early

Warning signs most leaders miss until it's too late

Welcome to SalesDaily for Leaders: your weekly briefing packed with actionable insights to help you manage better, coach smarter, and drive results in B2B sales.

Every Sunday, we provide the latest strategies, resources, and ideas for leading high-performing teams and staying ahead in today’s competitive landscape.

Let’s dive in!

In today’s issue:

Andy Byrne: Don’t cling to a broken GTM strategy

Danielle Kaetzer: Why CSQLs work better than MQLs

Mike Pinkel: Your 2026 revenue starts today

Mike Groeneveld: Your best quarter can be your worst enemy

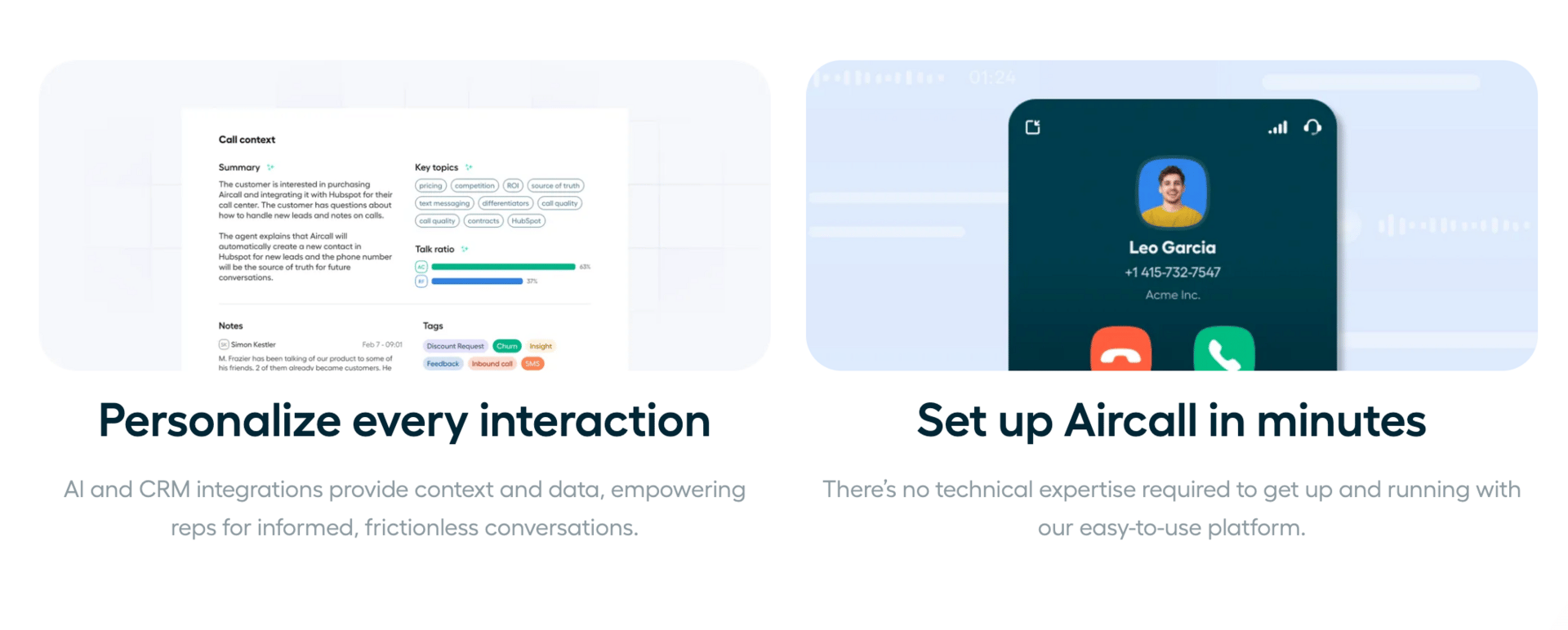

Sales leaders lose visibility the moment reps pick up the phone.

Aircall fixes that.

It gives you real-time insight into every call, every conversation, and every coaching opportunity - without sitting next to your reps.

Here's how it works:

1️⃣ Connect Aircall to your CRM and sales tools in minutes.

2️⃣ Track call volume, talk time, and outcomes automatically.

3️⃣ Listen to live calls, jump in when needed, or review recordings for coaching.

4️⃣ Get analytics that show who's performing, who's struggling, and where to focus.

The result: Better coaching, faster ramp times, and full pipeline visibility.

Teams at Uber, Birchbox, and Sendinblue use it to scale calling without losing control.

👉 Learn more at Aircall.com

Cap the comfort zone

Matt Green unpacks how one VP of Sales discovered his reps were over-reliant on inbound and neglecting high-value products, and what he changed to fix it.

Too busy for real selling

The team sold 3 products that prospects asked for by name.

The other 27 in the catalog? Collecting dust.

➤ 80% of the pipeline came from the 3 popular products

➤ But those only made up 30% of revenue potential

The bigger opportunity was in the neglected 27. Products that required outbound, skill, and effort.

Where the problem started

Reps weren’t selling. They were processing orders.

No one wanted to cold call or run discovery on harder-to-sell tools.

They hit quota fast with simple deals and stopped there.

Attempts to fix it by segmenting reps or product lines failed.

Why? Because this wasn’t a structure problem. It was a behavior problem.

➤ It exposed the gap between real salespeople and order takers.

How the VP changed the game

These four changes helped reset the culture and focus:

✔ Comp made the hard products more profitable

• 10% commission on core products

• 15% commission on the neglected 27

→ Selling the hard stuff became worth the effort

✔ Portfolio quotas enforced balance

• Reps had to generate 40% of their quota from non-core products

• No exceptions, no workarounds

✔ Outbound activity was tracked and required

• Reps needed 3 qualified opps per quarter from the 27 products

• Had to come from prospecting. No inbound allowed.

✔ "Easy" deals were capped

• Max 60% of quota could come from the 3 popular SKUs

• The rest had to come from products they’d been ignoring

This forced reps to stop hiding in inbound and start hunting again.

The real shift

Reps now had a reason to learn the full portfolio.

The best ones leaned into the challenge and made more money.

The rest? Still addicted to the ringing phone. Until it stops ringing.

➤ Inbound won't last forever

➤ Competitors will sell what your team avoids

👉 Power up your sales team

If you lead a sales team, run training sessions, or coach reps - this is for you.

With SalesDaily Elite, you get full white-label rights to my complete library of sales cheat sheets, guides, and templates.

✔️ Editable Canva files you can brand as your own

✔️ Ready-to-use for team onboarding, and workshops

✔️ Built for high-impact sales team enablement

Stop wasting time building resources from scratch.

Don’t cling to a broken GTM strategy

Andy Byrne says the edge doesn’t go to the biggest companies anymore. It goes to the ones that can move fast, with precision.

Misalignment is the silent killer

67% of enterprises missed revenue targets last year. Nearly half didn’t realize it until the quarter ended.

That lag is the real threat. Not the market, but leaders clinging to a plan that’s no longer working.

➤ Today’s environment demands more than speed. It requires precision and constant alignment

➤ Misalignment slows deals, burns spend, and breaks internal trust ⇢ even when the strategy looks solid on paper

➤ AI is exposing the cracks: companies chase potential but abandon initiatives because data, workflows, and teams don’t connect

Read the early signals and adjust

The strongest teams don’t wait for the quarter to close to course-correct.

They track the warning signs:

Forecasts are off, even with decent coverage

Expansion is working better than new business ⇢ but GTM hasn’t shifted

Win rates are flat while cycles get longer

These are signs of misalignment ⇢ not just poor execution.

✔ Identify them early

✔ Pause and reassess

✔ Shift the plan before it’s too late

How high-performing teams pivot

The playbook for strategic agility is clear:

✅ Start with unified data

Don’t rely on anecdotal feedback. Tie actions to outcomes across teams. AI can now surface leading indicators in real time.

✅ Double down on what’s working

If expansion closes faster, reweight the strategy. High-performers are using real-time deal inspection to reallocate GTM resources mid-quarter.

✅ Drive cross-functional alignment

No strategy works if sales, marketing, and CS are misaligned. Shared metrics and weekly operating cadences are non-negotiable.

✅ Tighten feedback loops

Stop waiting for QBRs. Use weekly operating forums to catch and fix issues in real time.

Palo Alto Networks, Adobe, and Okta are doing this now. They move fast because their strategy, systems, and teams are synced ⇢ and stay synced.

The edge no longer goes to the biggest org. It goes to the one that adapts fast ⇢ together.

Partnering with:

Mailshake: The leading travel and expense platform

Smartlead: Automate outreach without losing the human touch

Close: Manage relationships and scale outreach in one smart CRM

La Growth Machine: Multichannel prospecting that actually scales

(include affiliate links)

Why CSQLs work better than MQLs

Danielle Kaetzer maps out how Revenue Operations at Betterworks is shifting from a post-sale focus to a new-logo growth engine—and why customer journey mapping is the anchor for all of it.

Start with the customer journey

Most RevOps teams start with tools or metrics. Danielle flips that: start with mapping your actual customer journey.

Pull in stakeholders from sales, marketing, and CS

Use tools like Miro to sketch touchpoints, gaps, and ownership

Look at KPIs you are tracking and those you aren’t

Identify where tech, people, or process are disconnected

This exercise helped reveal low-hanging gaps in post-sale workflows—even in teams that thought they were solid.

CSQLs (Customer Success Qualified Leads) aren't theory

Danielle built an end-to-end workflow for CSQLs, modeled on acquisition tactics:

✓ Train CS teams to recognize commercial signals during value conversations ✓ Document compelling events in handoff notes ✓ Route to account managers for review ✓ Run biweekly feedback loops to refine signal quality

This isn’t passive handoff. It’s structured, trackable, and includes accountability on both sides.

What she changed in her first 90 days

At Betterworks, Danielle quickly shifted focus to the top of funnel:

➜ Mapped where marketing > SDR > AE handoffs were breaking ➜ Rebuilt their tech stack to reduce friction, save cost, and improve transparency ➜ Introduced playbooks with clear throughline messaging from nurture to outreach to sales

Playbooks in action

Competitive end-of-life campaigns:

Built target list of 200+ affected accounts

Orchestrated ABM campaign across marketing and sales

Thematic nurture-to-outreach flows:

4 separate nurture themes (e.g. employee engagement)

Outreach sequences match the same themes for tighter handoff

From volume to value: new KPIs

They moved beyond simple activity metrics to surface quality:

Added pipeline conversion rates per rep

Built an ICP fit score that includes: ➜ Traditional firmographics ➜ Compelling events (e.g. funding, layoffs, M&A) ➜ 6sense intent data

Early signal: all recent closed-won deals scored 8+ on the new ICP index.

Tech stack rethink

Cut $75K from their stack by moving from overbuilt prospecting automation to:

LeanData for routing

Cognism for outbound

6sense for company-level intent

Result: faster routing, clearer data, better rep trust.

One piece of advice

Get close to your customer journey. It will show you where the revenue really is.

Your 2026 revenue starts today

Mike Pinkel delivers a sharp warning: if you wait until January to plan 2026, you're already late.

Start now, or fall behind

If your sales cycle is 4 months (or longer), your Q1 pipeline is already at risk if you're not building it now.

Hiring, onboarding, ramping, and generating revenue all take time. Starting late means revenue shows up too late to matter.

The math is against you

➤ New AE hires

3 months to hire + 6 months to full productivity

Hire in October ⇒ productive by July 2026

Hire in January ⇒ productive by October 2026 ⇢ too late to drive the year

➤ SDR hires

3 months to hire, 1 month to ramp, 4-month sales cycle = 8 months to revenue

Hire in October ⇒ results in June

Hire in January ⇒ results in September ⇢ barely helps Q4

✘ Magical thinking like “we’ll ramp faster” or “these big deals will close” creates a false sense of confidence

✘ Spreadsheets can make bad assumptions look good until it’s too late to course-correct

Work backwards from your revenue plan

Don't start in Excel. Start with these 4 buckets:

✔ Existing pipeline

Keep building in Q4 so Q1 isn’t empty

✔ New pipeline

Needs the longest lead time. Test and scale what’s working now

✔ Renewals

Flag churn risks now. Usage problems don’t get fixed in December

✔ Expansion

Big expansions take 6 months to land. Start those conversations this quarter

The price of waiting

Waiting until January delays your entire revenue machine. Every month you postpone hiring, pipeline generation, or expansion conversations sets you back another quarter.

⇒ Plan now while you still have time to impact Q1 and Q2.

TO-GO

Mike Groeneveld: Your best quarter can be your worst enemy

Chris Orlob: The number one job of revenue leaders

Patrick Trümpi: Key principles of sales commission plans

Brandon Fluharty: Two “truths” in strategic sales

QUOTE OF THE DAY

"Great sales leaders are process-obsessed and people-focused. That’s the mix."

PODCASTS

HUMOR